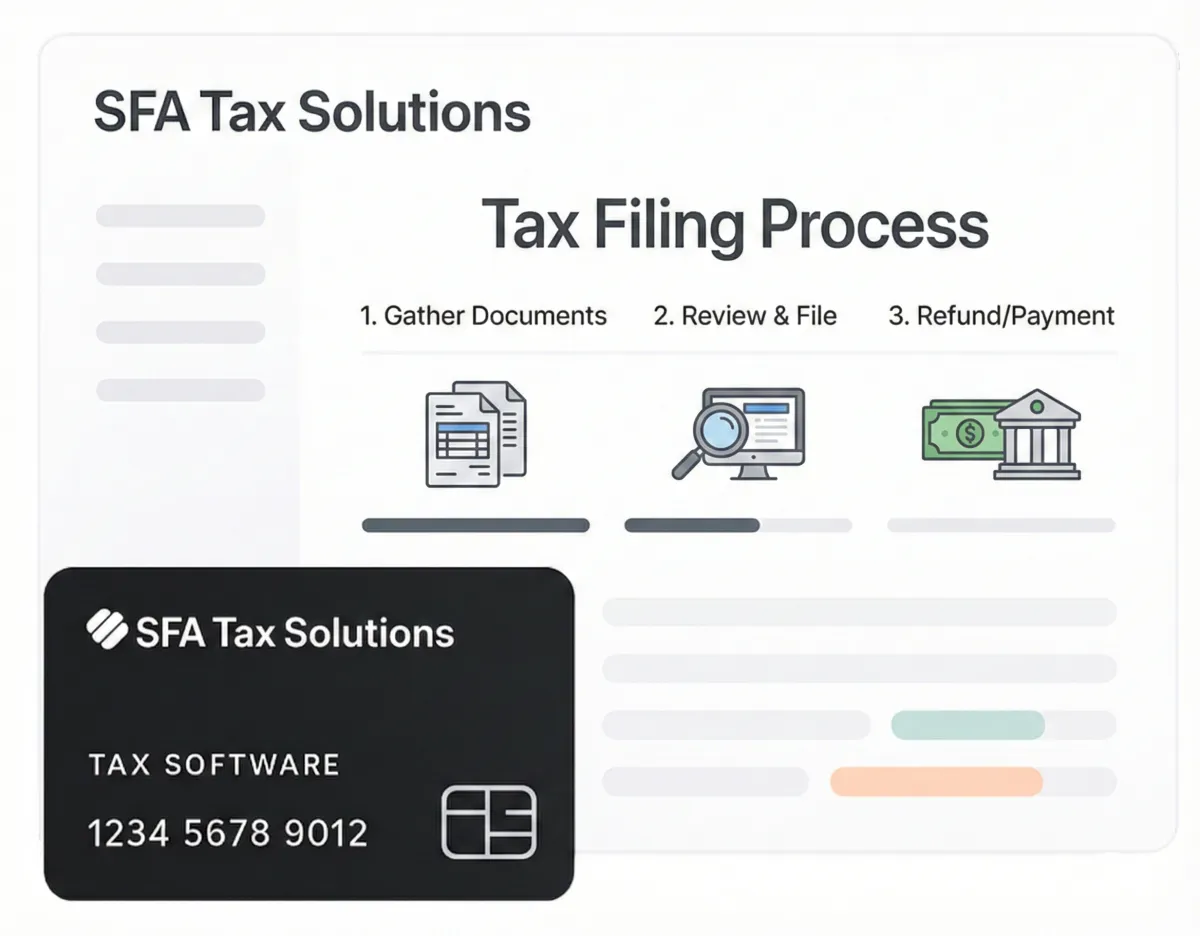

Centralized Tax Dashboard

Track every return, refund estimate, and key deadline in one live view so you always know exactly where your taxes stand.

Discover stress-free tax filing with expert guidance from Sfa Tax Solution. Start today and experience a new level of confidence this tax season.

Discover stress-free tax filing with expert guidance from Sfa Tax Pro. Start today and experience a new level of confidence this tax season.

Start with tax services that just work

We’re committed to simplifying the way individuals and businesses handle their taxes — making it faster, clearer, and stress-free from day one.

Track every return, refund estimate, and key deadline in one live view so you always know exactly where your taxes stand.

Your receipts and transactions are grouped into clear tax categories so you can confidently claim every deduction you’re entitled to.

Keep personal, business, and side-income taxes separate with dedicated profiles that stay organized, compliant, and easy to manage year after year.

Start with tax services that just work

We’re committed to simplifying the way individuals and businesses handle their taxes — making it faster, clearer, and stress-free from day one.

Track every return, refund estimate, and key deadline in one live view so you always know exactly where your taxes stand.

Your receipts and transactions are grouped into clear tax categories so you can confidently claim every deduction you’re entitled to.

Keep personal, business, and side-income taxes separate with dedicated profiles that stay organized, compliant, and easy to manage year after year.

We’re here to simplify how individuals and companies manage their taxes — making it faster, clearer, and completely stress-free from day one.

We’re here to simplify how individuals and companies manage their taxes — making it faster, clearer, and

completely stress-free from day one.

Maximize your tax potential with expert-backed filing

And keep more of your money where it belongs — with you.

Keep more of what you earn with proactive planning, accurate filings, and clear visibility into every tax move.

Onboard once, connect your documents, and let SFA TaxPro organize everything needed to file correctly and on time.

See the impact of key decisions ahead of time with simple visuals that highlight your liabilities and potential savings.

From reminders and document chasing to filing prep and follow-ups, SFA TaxPro keeps your tax processes running quietly in the background.

Maximize your tax potential with expert-backed filing

And keep more of your money where it belongs — with you.

Keep more of what you earn with proactive planning, accurate filings, and clear visibility into every tax move.

Onboard once, connect your documents, and let SFA TaxPro organize everything needed to file correctly and on time.

See the impact of key decisions ahead of time with simple visuals that highlight your liabilities and potential savings.

From reminders and document chasing to filing prep and follow-ups, SFA TaxPro keeps your tax processes running quietly in the background.

SFA TaxPro blends human expertise with automation so every stage of your tax process from intake to filing, stays organized, accurate, and under control.

Centralize W-2s, 1099s and receipts in one clean workspace with guided checklists.

AI reads your forms, pulls every value, and flags highlights instantly.

Rules flag missing disclosures, risky inputs and gaps before filing.

Track each tax return end-to-end with a clean real-time timeline.

SFA TaxPro blends human expertise with automation so every stage of your tax process from intake to filing, stays organized, accurate, and under control.

Centralize W-2s, 1099s and receipts in one clean workspace with guided checklists.

AI reads your forms, pulls every value, and flags highlights instantly.

Rules flag missing disclosures, risky inputs and gaps before filing.

Track each tax return end-to-end with a clean real-time timeline.

Real professionals guiding every step of your filing.

Senior Tax Specialist

Aria is your go-to expert for personal tax filings and maximizing every credit you qualify for. She walks you through your return step-by-step and helps uncover deductions most people miss, so tax season feels calm and stress-free. Talk to Aria →

Business Filing Advisor

Evan takes care of LLCs, S-Corps and C-Corps so you never miss a deadline or compliance rule. He keeps your filings clean, organized and ready for growth—without the confusing tax jargon. Talk to Evan →

IRS Compliance Specialist

Erica is your ally for IRS letters, audits, payment plans and past-due returns. She focuses on protecting your finances while resolving issues fast and professionally. Talk to Erica →

SFA TaxPro combines human expertise with smart automation to give you

intelligent, always-on support across every step of your tax workflow.

Get step-by-step guidance from an AI assistant that speaks tax, flags issues in real time, and keeps you confident from intake to filing.

See the impact of decisions instantly with live projections, scenario planning, and easy-to-read summaries powered by AI.

Upload or snap a photo and let AI extract every line item from your documents into clean, review-ready data.

Built-in rules help prevent missed disclosures, risky inputs, and non-compliant filings before they ever reach the IRS.

Turn repetitive tasks into hands-free flows—from reminders and follow-ups to status updates and notifications.

Collaborate in one AI-assisted hub where messages, documents, and decisions stay synced.

Clear, Simple, Stress-Free

No hidden fees. No surprises. Choose the plan that matches your tax needs and let SFA Tax Solutions handle the heavy lifting.

Federal Form 1040, document review, one-on-one consultation, compliance review.

Schedules A, B, C, D, E, 1–3, credits, ACA & education forms (as applicable).

Tax law research, deduction & credit analysis, audit-risk reduction.

Unlimited calls related to return, IRS support, post-filing assistance.

Clear, Simple, Stress-Free

No hidden fees. No surprises. Choose the plan that matches your tax needs and let SFA Tax Solutions handle the heavy lifting.

Federal Form 1040, document review, one-on-one consultation, compliance review.

Schedules A, B, C, D, E, 1–3, credits, ACA & education forms (as applicable).

Tax law research, deduction & credit analysis, audit-risk reduction.

Unlimited calls related to return, IRS support, post-filing assistance.

Answers to the most common questions about how SFA TaxPro simplifies filing,

enhances accuracy, and automates your entire tax workflow.

Answers to the most common questions about how SFA TaxPro simplifies filing,

enhances accuracy, and automates your entire tax workflow.

We’re here to simplify how individuals and companies manage their taxes — making it faster, clearer, and completely stress-free from day one.

Uninterrupted Support

Financial Clarity & Control

Personalized Tax Guidance

We’re here to simplify how individuals and companies manage their taxes — making it faster, clearer, and completely stress-free from day one.

Uninterrupted Support

Financial Clarity & Control

Personalized Tax Guidance